Rand on the rampage as dollar gets slammed

South Africa is riding a wave of a weaker dollar coupled with strong fundamentals locally.

Image: RON | AI

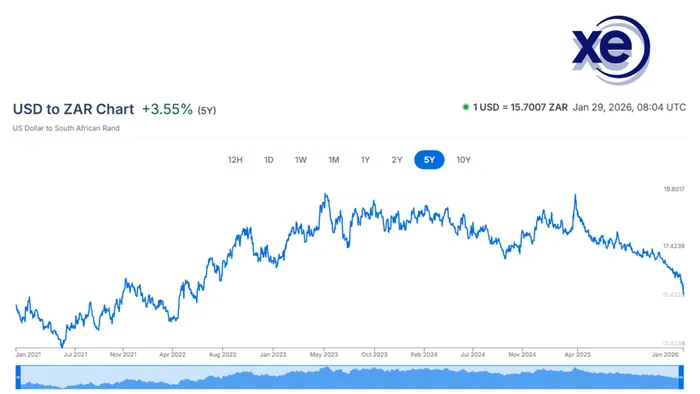

The South African rand is hitting levels last seen four years ago as traders move away from the greenback towards riskier assets on the back of US President Donald Trump creating policy uncertainty.

This dollar debasement trend has pushed the local currency below R16, trading around the R15.71 level on Thursday morning - its strongest against the dollar since mid-2022. Over the next few months, the rand could drift towards a R14/$ handle and trade in a R14.00 to R14.99 range, said PSG Financial Services chief economist Johann Els.

“The rand will potentially be more stable over the next few years,” he said.

The rand has gained 3.1% against the US dollar this year, while the dollar itself has fallen 1.1%, said Investec chief economist Annabel Bishop in a note earlier this week.

Overall, South Africa is quietly proving itself a standout investment story as 2026 begins, given the rand's continuing momentum, precious metals hitting record highs, and structural improvements underpinning a more resilient economy.

Gold extended its record-breaking rally above $5,500 per ounce on Thursday, hitting a fresh high amid continued weakness in the US dollar and heightened economic and geopolitical uncertainty, Trading Economics noted.

JP Morgan’s most recent forecast sees gold reaching $5,000 an ounce by the end of the year.

Platinum has also benefited from global safe-haven demand, helping to underpin South Africa’s key export revenues.

Precious metals are performing exceptionally well in an environment of heightened geopolitical tension, which is boosting rand strength,” Bishop said.

Gold has been supported by safe-haven flows amid geopolitical tensions in Venezuela and Iran, alongside renewed concerns over the independence of the Federal Reserve.

South Africa's currency is on a winning streak as traders bet against the dollar because of US policy uncertainty.

Image: XE.com

Metals prices are also buoying the JSE, with Anchor Capital fund manager Peter Little pointing to the fact that a significant portion of recent value gains on the bourse can be attributed to gold and platinum stocks.

Little noted that the FTSE/JSE All Share Index is up 6.6% year-to-date.

Analysts say the surge is not only being driven by the weaker dollar but also by strong local fundamentals.

Anchor Capital co-chief investment officer Nolan Wapenaar highlighted international factors behind the rand's rally, including political uncertainty and civil unrest in the US, which have eroded confidence in the dollar.

“In the flight out of the dollar, gold as an alternative safe-haven asset has appreciated to record highs,” Wapenaar said.

Wapenaar said this is “of double benefit for South Africa because we stand to benefit from the record high gold and metals prices with meaningful increases in tax revenues for the country and also record receipts of dollars for our export minerals”.

Els said the dollar was under pressure in reaction to uncertainty around US fiscal policies and renewed threats of trade tariffs.

Most recently, US President Donald Trump threatened Canada with 100% tariffs should it conclude a trade deal with China.

The Bloomberg Dollar Spot Index’s drop in the three days prior to Tuesday is the steepest since the US tariff turbulence in April last year.

“The dollar is probably heading towards a weaker trend over the next several years… the dollar could potentially remain weaker for some time to come,” Els said.

A weaker dollar is good news for commodities, Els said.

TreasuryONE head of market risk, Wichard Cilliers noted that “the dollar fell sharply after Trump expressed happiness with the weaker dollar, triggering a further sell-off”.

Els also said local structural improvements are amplifying these gains.

Easing electricity constraints, improved access to Transnet’s logistics systems, and private sector investment in infrastructure are reducing bottlenecks that have long limited growth, he said.

Gold's boost past $5,500 has already beat JP Morgan's year-end timeline for it to reach $5,000.

Image: Trading Economics

Els said he is confident about South Africa’s status as an investment destination. “I expect more ratings upgrades this year and next year and for South Africa to at least have one or two investment grade ratings within two to three years,” he said.

Two of the three major credit rating agencies, S&P and Fitch, downgraded South Africa to sub-investment grade in 2017 following a cabinet reshuffle under former president Jacob Zuma.

The third, Moody’s, downgraded South Africa in March 2020 after the announcement of an Eskom bailout in the medium-term budget policy statement.

Last year, however, S&P upgraded South Africa’s rating for the first time in more than two decades.

IOL BUSINESS

Get your news on the go. Download the latest IOL App for Android and IOS now.

Related Topics: