WATCH: Interest rate remains unchanged

Lesetja Kganyago, governor of the South African Reserve Bank.

Image: SARB | Facebook

The South African Reserve Bank (SARB’s) has opted to keep the repo rate unchanged at 6.75%. The announcement was made by Reserve Bank Lesetja Kganyago on Thursday.

The prime lending rate is currently at 10.25%, with the rate having dropped a cumulative 1.25 percentage points since September 2024.

Johann Els, chief economist at PSG Financial Services, said earlier this week that he expected more rate cuts this year.

Investec chief economist Annabel Bishop noted that financial markets had priced in a 44% probability of a 0.25 percentage point cut occurring in the repo rate on Thursday.

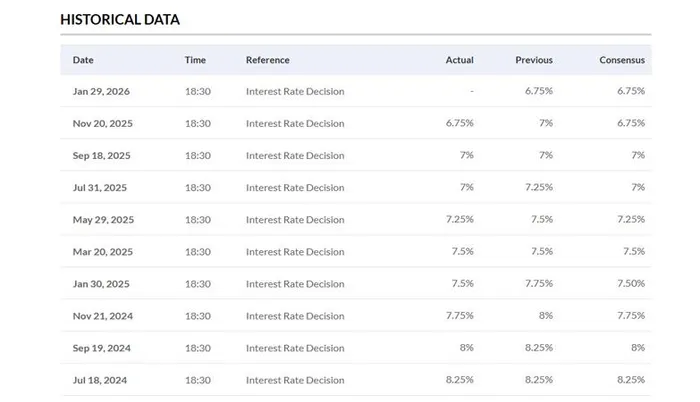

A historical view of the South African Reserve Bank's interest rate decisions.

Image: moneycontrol.com

Global caution

The MPC meeting comes a day after the US Federal Reserve left that country’s interest rate unchanged, which followed having made three successive cuts of 0.25 percentage points.

Bishop said that the cautious approach being taken in the US could be “echoed by South Africa’s monetary policy committee today”.

Given that the rate has been cut by a full percentage point over the course of last year, SARB “is likely in no rush to cut further, on balance, but will assess inflationary factors closely,” says Bishop.

December’s inflation figure – the latest available data – edged somewhat higher to 3.6%, which was up a percentage point on November’s figure. Statistics South Africa’s data showed that housing and utilities remained the largest contributor to annual inflation.

Food and non-alcoholic beverages also continued to add upward pressure. Food inflation remained unchanged at 4.4% year-on-year in December.

In November, SARB Governor Lesetja Kganyago said he sees inflation heading lower again from the beginning of this year. “Indeed, recent outcomes have undershot our forecasts slightly,” he said.

Bishop expects inflation to drop back to the 3% inflation target this quarter.

The central bank is targeting a rate of 3% with a one percentage point tolerance band on either side. As such, inflation is still within an acceptable range.

Property sector calls for rate cuts

Real estate group Seeff called on the central bank to cut rates this afternoon. It said, aside from a vital 25 percentage point reduction this week, SARB should also set the tone for a further 25 percentage point cut before mid-year.

“Ultimately, the aim must be to move closer to the 7% prime rate seen during the pandemic, which kickstarted the economy and resulted in gross domestic product (GDP) growth of close to 5% in 2021,” the real estate agency said.

Currently, economic growth is 0.5%, based on the latest available figure for the third quarter. The full year number has yet to be released, although forecasts vary between 1.2% and 1.5%. In 2024, GDP gained 0.5%.

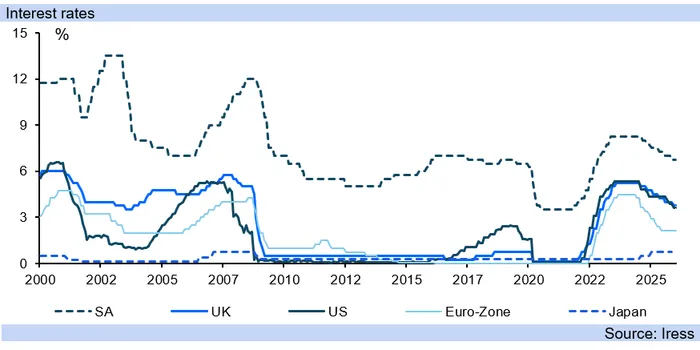

A comparison of interest rates across several key economies against South Africa's rate.

Image: Iress

Stephen Whitcombe, MD of property group FIRZT Realty, noted that there is growing consensus among economists that further interest rate decreases are likely during the course of 2026, provided that global monetary conditions remain supportive.

“Most are predicting that rates will come down by 100 to 150 basis points over the next 12 months and as we know, even modest cuts can have a meaningful impact on the property market,” said Whitcombe.

“Lower interest rates improve affordability, increase buyers’ borrowing capacity and boost confidence, particularly among first-time buyers and upgraders.”

Jobs dilemma

Seef added that the “overwhelming challenge for the country remains unemployment; to combat this, we need 4% to 5% growth for a decade”

The real estate agency said “we must move beyond talking and take the decisive action needed to bring the cost of debt down, free up disposable income and unlock investment and growth in the economy as illustrated in 2021”.

Bishop has indicated that GDP growth of at least 3% is needed for meaningful job growth. IOL’s calculations based on available Statistics South Africa data shows that almost 25,000 jobs were lost last year.

IOL BUSINESS

Get your news on the go. Download the latest IOL App for Android and IOS now.

Related Topics: