Muvhango Lukhaimane, the Pension Funds Adjudicator.

Image: Supplied

A provident fund has been slammed by the Office of the Pension Funds Adjudicator (OPFA) for paying a member without consent and ignoring the fund’s own rules.

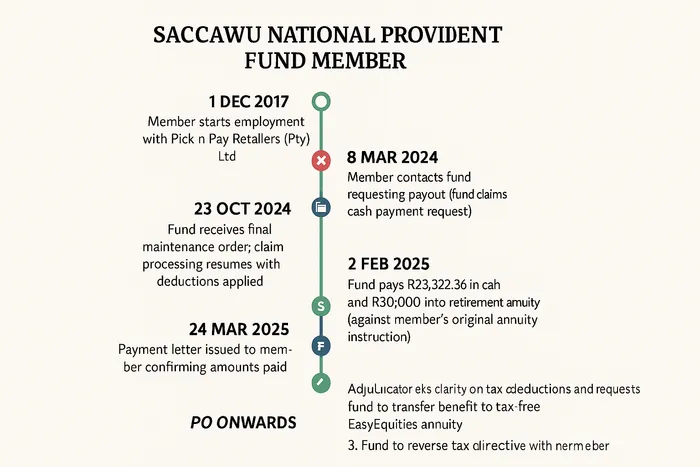

Adjudicator Muvhango Lukhaimane said the South African Commercial, Catering and Allied Workers Union National Provident Fund ignored the complainant’s repeated requests to transfer his benefit into a tax-free EasyEquities annuity.

Instead, he received a cash payout of R23 322.36 and R30 000 into a retirement annuity on February 2, 2025.

This was the catalyst for the matter eventually ending up at the OPFA.

The back-and-forth began when the member contacted the fund multiple times. He asked for a transfer to his annuity, queried tax deductions, and requested proof of employer contributions.

The fund insisted he had requested a cash payment via its contact centre on 8 March 2024. But it could not produce a recording of the call or a completed withdrawal form, Lukhaimane said.

Lukhaimane added that, “in the absence of proof of the complainant’s instruction being heeded to, the fund acted in contravention of the rules and failed to ensure that the interests of members are protected at all times”.

Timeline of SACAWU member's dispute over pension fund withdrawal.

Image: ChatGPT

Complicating the matter was a maintenance order deduction as well as a tax amount on the full benefit and not on tax due to the South African Revenue Service (SARS).

Failure by a pension fund to provide relevant information required by a member or a beneficiary for the exercise of their rights constitutes a breach of the duty to act in good faith and amounts to an improper exercise of powers and maladministration of the fund, Lukhaimane said.

The adjudicator, in her order, determined that the member to choose how he wants his benefit paid.

If he elects a transfer to a pension, provident, retirement annuity, preservation, or provident preservation fund, he must refund the amount already received, Lukhaimane said.

The fund must also liaise with SARS to reverse and revise the tax directive.

The ruling comes amid a rise in retirement fund complaints.

The OPFA reported a 13% increase in complaints in 2024/25, partly due to the two-pot system, which lets members access savings without leaving employment.

Non-compliance by employers failing to pay contributions remained widespread, accounting for 44.34% of complaints, while withdrawal disputes made up 38.79%.

The Financial Services Conduct Authority has flagged 5 830 employers who are not meeting their legal obligation to pay pension deductions within seven days.

IOL Business

Related Topics: