SARB Governor warns of modest growth impact from US tariffs and global factors

ECONOMY

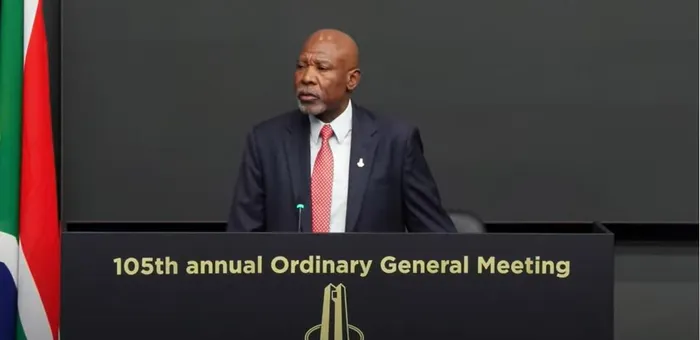

Governor Lesetja Kganyago was speaking at Sarb's 105th annual Ordinary General Meeting (AGM) in Pretoria on Friday.

Image: SARB YouTube screengrab

South African Reserve Bank (Sarb) Governor Lesetja Kganyago has warned that preliminary assessments suggested that South Africa's growth was being modestly affected by the United States' tariffs and other external economic factors.

Kganyago on Friday said that despite the US being a significant trading partner, it was Europe, China, and the Southern African Development Community (SADC) that still held the most weight in South Africa's export dynamics.

"In South Africa, our preliminary assessment is that tariffs and the other uncertainties in the global economy are causing modest damage to growth while leaving inflation broadly unchanged," Kganyago said.

"Our exports to the US mostly consist of commodities − some of which are exempted− and manufactured products such as cars. Some parts of the agricultural sector are exposed, but total agricultural exports are only about 3% of our total exports to the US."

As part of the latest economic forecasts, Kganyago said the Sarb has accounted for an increase in tariff rates, resulting in a minor adjustment of the growth projection, now estimated to lower by approximately 0.1 percentage points for this year.

Kganyago said though this represented a setback, it was not considered catastrophic.

"Unfortunately, our growth rate for the year is still looking low, close to 1%. This continues a stagnation trend that has been in place for roughly a decade. The economy grew at about 4% a year during the 2000s, then slowed down steadily during the first half of the 2010s, and has hovered at growth rates of about 1% ever since," Kganyago said.

"As we have said repeatedly in our monetary policy statements, the drivers of weak growth are mainly structural and require structural reforms. Put in plainer language, without economic jargon, we need the trains to run and the cities to function. Given the reform momentum underway – perhaps best illustrated by improved electricity availability – we see some scope for better growth in the coming years."

He said the efforts by the National Treasury to stabilise debt were expected to bolster public confidence, adding that the economy was also benefiting from lower interest rates, with the policy rate being reduced by 125 basis points since September 2024, thus facilitating easier borrowing conditions.

Compounding the effects on the economy is the global inflation surge witnessed in 2022 and 2023, which South Africa felt intensely. Yet, in a silver lining, inflation has sharply decelerated in 2024, as recent trends indicate that prices are only up by 3% over the past year.

Though there were notable risks, including a spike in oil prices following geopolitical tensions in Iran, and a sharp depreciation of the rand earlier this year, Kganyago said these hurdles have been swiftly managed, enabling inflation to remain under control.

Moving beyond monetary policy, Kganyago said the Sarb had started a new strategy cycle this year.

He said one important change was that the bank had streamlined its strategic focus areas to just three: price stability, financial stability, and payments.

"These are the three integral functions of the Sarb: our fundamental value to society is money that holds its value, and that can be used in a stable financial system to make payments efficiently," he said.

"Elevating these three roles will help keep the organisation focused on its unique contribution to the well-being of South Africans."

Kganyago was speaking at Sarb's 105th annual Ordinary General Meeting (AGM) in Pretoria.

The Sarb reported an unusually large profits of R118 billion after tax, mostly reflecting the R100bn received from the National Treasury as part of the new Gold and Foreign Exchange Contingency Reserve Account (GFECRA) settlement agreement.

Kganyago said this strengthened the Sarb's capital position so that it could also pay out a portion of the GFECRA funds to the government, which is the legal owner of these balances, and could do so without selling off foreign exchange reserves.

"On that subject, I can also report that foreign exchange reserves are now around $68bn, up by about $20bn over the past 10 years. We are a long way from having the strongest reserve position among emerging markets, but we are no longer the laggard we once were," he said.

BUSINESS REPORT