Financial markets: The JSE ALSI is a silent warrior, with fuel prices heading for another cut

MARKETS ON MONDAY

This coming week investors domestic and foreign await the release of South Africa’s inflation rate for April to be released by STASSA on Wednesday.

Image: File.

Despite all the attention on the US trade debate and the South African lack of budget consensus, the worrying unemployment data (32.9%) for Q1, the ALSI on the JSE continue its impressive performance.

The index closed on Friday on 92 619, only twenty points away from its record level of 92 638, which was recorded last Tuesday.

Not only did ALSI end the week with 0.9% in the green but it is now 9.7% up for the year to date. Foreign buying interests in SA shares, the strong recovery in Naspers and Prosus saw the Rand exchange rate moving close to the R18.00/$ level. Financial shares were the best performer on the JSE last week as the FIN15 index gained 2.7%.

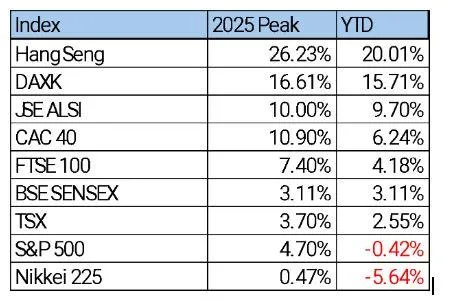

JSE ALSI compared with other global indices. (15 May 2025)

JSE ALSI compared with other global indices. (15 May 2025)

Image: Supplied.

On the foreign exchange market, the Rand improved against the US$ over the week by thirty cents to close on Friday at R18.04/$.

This is the strongest level for the year-to-date. Against the British £ the Rand improved by twenty-five cents to R23.96/ £ and against the Euro appreciated the last five days by twenty-two cents to R20.12/€.

Given the stable but lower Brent oil price around $65 per barrel, the price for fuel is expected to come down by between twenty-two cents (petrol) and fifty-seven cents (diesel) at the beginning of June 2025.

In the week after the drastic cut in the proposed tariff increases by both the USA (down from 147%) and China (down from 120%) to 30% and 10% on imports from the other one, S&P500 on Wall Street shot up by 5,5%, whereas the Shanghai in China initially recovered last week up to Wednesday by increasing 2.2%, but ended Friday flat for the week, with 22 point gaining only 0.65% on the pre-trade US trade discussions level the previous weekend.

This coming week investors domestic and foreign await the release of South Africa’s inflation rate for April to be released by STASSA on Wednesday.

It is expected that the annual increase in the CPI will be 2.9%. This is higher than the annual inflation rate of 2.7% recorded for March 2025, but still lower than the 3.0% target envisaged by the Monetary Policy Committee of the Reserve Bank, that it had set “unofficially” for their new inflation rate target.

It also will be the ninth consecutive month that the rate is lower than the current midpoint target of 4.5%.

The debate around when the MPC lowers its repo rate will continue. A rate of lower than 3.0% will be favorable for the Rand and especially financial shares. STATSSA will also publish the retail sales for March 2025 on Wednesday.

The meeting between President Trump and President Ramaphosa on Wednesday will also attract attention of investors and will also affect equity prices, bond rates and the rand exchange rate.

Globally countries like Great Britain, Canada, Japan, and the EU will announce their inflation rates for April during the week. China will release its retail numbers for April today. In the US data on home sales, jobless claims, and various Purchasers Managers Indices (PMI’s) will be announced.

Chris Harmse is the consulting economist of Sequoia Capital Management and a senior lecturer at Stadio Higher Education.

Chris Harmse is the consulting economist of Sequoia Capital Management and a senior lecturer at Stadio Higher Education.

Image: Supplied

BUSINESS REPORT

Visit: www.businessreport.co.za