Generational home affordability: why the 20-year-old today is locked out

While young adults today may earn more in absolute or purchasing-power terms than Boomers did, the minimum income required to buy a first home has increased sharply, making first-time homeownership largely out of reach for the average 20-year-old.

Image: Freepik

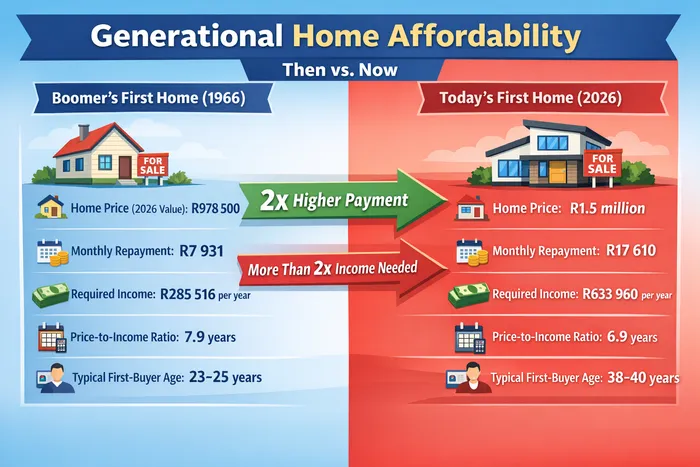

Buying a first home has always been a major financial milestone, but the hurdles young buyers face today are dramatically different from those faced by Boomers in 1966.

While young adults today may earn more in absolute or purchasing-power terms than Boomers did, the minimum income required to buy a first home has increased sharply, making first-time homeownership largely out of reach for the average 20-year-old.

In 1966, a typical home cost R9,500. Under a 20-year bond at 7.5% prime and a lending guideline that no more than a third of income goes to bond repayments, a 20-year-old would have needed to earn roughly R2,772 per year, or R231 per month, to qualify.

If adjusted for purchasing power, that 1966 income is equivalent to around R285,516 per year today, while the 1966 monthly repayment of R77 would be about R7,931 in today's money.

According to Lightstone data, in 2024 young adults aged 20 to 35 accounted for almost 30% of all property transactions, with 17% of them paying between R1 million and R1.5 million.

Using the upper end of this range, at R1.5 million and a 20-year bond at 10.25% prime, a bank would require a 20-year-old to earn R633,960 per year (roughly R52,830 per month) to meet the typical 1/3-of-income rule.

That would bring today's monthly repayment to R17,610 – more than double granddad's R7,931.

Even though price-to-income ratios suggest homes today are slightly more affordable relative to earnings (6.9 years vs 7.9 years in 1966), the required income to qualify for a mortgage today is far higher. And that's because of interest rates.

A 60-year view of salaries, interest rates, and the cost of a home shows why houses are less affordable now than they were for granddad.

Image: ChatGPT

Rate hold doesn't help

Thursday's decision by the South African Reserve Bank to keep the prime lending rate unchanged at 10.25% will not make it any easier for young first-time buyers to own property.

Samuel Seeff, chairman of the Seeff Property Group, calls Thursday's decision "hugely disappointing and a massive, missed opportunity". He says that the Reserve Bank had the "breathing room" to cut.

Bradd Bendall, BetterBond's national head of sales says "expectations were high that the South African Reserve Bank would start the year with more good news for consumers".

Investec chief economist Annabel Bishop noted ahead of the announcement that financial markets had priced in a 44% probability of a 0.25 percentage point cut occurring in the repo rate. While this was still below a 50% likelihood, it was up from only a 20% probability a week ago, she said.

Bishop has previously said that two cuts of 0.25 percentage points – one in March and another in September – are possible. The Monetary Policy Committee meets again in March.

Dr Elna Moolman, Standard Bank Group head of South Africa Macroeconomic Research, says that the bank's decision to hold rates steady seems to reflect its ongoing concerns around some of the forecast risks, including from the global economy.

SARB's model has scope for another 0.75 percentage points worth of cuts in 2026 and 2027, which Moolman says could happen sooner if inflationary pressures remain at bay and the rand remains stronger.

Market reaction mixed

Not everyone was disappointed. Adriaan Grove, founder and MD at MyProperty, says keeping the lending rate unchanged provides "homeowners with much-needed predictability for their monthly budgets".

Grove says, for those looking to enter the market, "this period of stability represents a strategic sweet spot". He says that with prime holding at 10.25%, borrowing is more attractive than in previous years, making homeownership more attainable for a wider segment of the population.

The South African Reserve Bank has already reduced interest rates by a total of 150 basis points since September 2024. These cuts have helped create a more accommodative lending environment, and BetterBond's January data shows that home loan applications are up 8.9% year-on-year.

While the lower rate has eased consumer debt slightly and improved property affordability and sales, Seeff says overall sales volumes remain well below where they should be. Compared to 2021, transaction volumes are effectively still trading 26.5% lower, its figures show.

Deposits and demographics

BetterBond's January Property Brief indicates that the average house price paid by first-time buyers reached a new record high of just above R1.3 million. This compares with an average price of R1.44 million according to bond originator ooba.

At the same time, there has been a downward trend in the average deposit requirements for first-time buyers according to BetterBond. This figure came in at R150 000 in the fourth quarter of last year, a 5.6% drop on the prior three months and a 15% year-on-year decline.

However, commenting in BetterBond's property brief, independent economist Dr Roelof Botha notes that while the decline is welcome, "it remains a point of concern to prospective homebuyers that the average deposit requirement for first-time buyers remains 30% higher than at the beginning of 2021, despite a relatively low ratio of bank impairments to bank assets".

Homebuying is also happening much later today than in the Boomer era. Historical data indicates the average first-time buyer in the 1960s was in their early to mid-20s – around 23 to 25 years old – significantly younger than the typical first-time buyer today.

By contrast, today's first-time buyers are significantly older, with the median age at around 38 to 40 years (2024 to 2025 data). This reflects a shift in affordability pressures and financial circumstances for younger generations.

PERSONAL FINANCE

Related Topics: