National Budget: without tax breaks, inflation will quietly push you into a higher tax bracket

Operating as a tax practitioner without the necessary registration constitutes a criminal offence. Consequently, if convicted, the tax practitioner may be liable for substantial financial penalties and/or imprisonment. While Finance Minister Enoch Godongwana is unlikely to announce a dramatic increase in personal income tax rates when he tables the National Budget next Wednesday, stealth tax will result in increased pressure, even without tax hikes.

Image: File photo.

As Finance Minister Enoch Godongwana prepares to take to the podium next Wednesday, South Africans will be waiting to hear about one key aspect in particular: tax.

Lance Collop, CA (SA) and Chartered Tax Accountant, says the key question many people want answered is whether taxes will increase. While Godongwana is unlikely to announce a dramatic increase in personal income tax rates, stealth tax will result in increased pressure, even without tax hikes.

“The National Budget is where such policy ideals and financial realities meet and often clash,” says Old Mutual Wealth investment strategist, Izak Odendaal. “Spending needs are great, but every additional rand for the police, for instance, must come from somewhere.”

Odendaal warns that raising tax rates is not always effective. “Taxpayers can cough up, but given a narrow tax base, higher tax rates can end up being counterproductive and discourage economic activity,” he says.

FNB Integrated Advice product head Ester Ochse says, “when most of your income goes to essentials, there’s very little room for surprises”. “National Budget season matters because it signals what shape your financial reality will take over the year ahead, and where one might need to make adjustments.”

“The government’s most effective tool for raising revenue isn’t a new tax law; it’s inflation,” Collop explains. “If you receive an inflation-linked salary increase this year – say 5% – but the tax brackets aren’t adjusted to match it, you effectively get pushed into a higher tax bracket,” he says.

As a result, “you earn more on paper, but you take home less in real terms”.

Ania Strydom, payroll compliance research manager at Deel Local Payroll, adds that fiscal constraints make inflation-linked tax relief adjustments unlikely. For the third year running, tax brackets may not change. So instead of raising tax rates, government effectively collects more when salary increases push people into higher brackets.

The National Budget could result in tax creep if he doesn't lower PAYE tax because salaries won't keep up with inflation.

Image: ChatGPT

A differing view comes from Maarten Ackerman, chief economist at Citadel, who says that Citadel does expect the “usual adjustments for bracket creep, but no significant changes to personal or corporate income tax rates”. Ackerman cautions, however, that “sin taxes may increase, potentially more aggressively than usual”.

After strong political and social opposition last year, VAT increases remain an unpleasant concept. “Given last year’s political challenges around VAT, it is highly unlikely that the government will revisit a VAT hike,” says Ackerman. Treasury may also resist expanding VAT zero-rating to more goods, even as cost-of-living pressures fuel renewed debate.

Strydom notes that tax on alcohol and tobacco may again rise above inflation. “However, illicit trade poses a growing risk to these revenues, potentially prompting stronger enforcement”.

In mid-January, BAT South Africa closed its only manufacturing plant due to illicit cigarette trade, putting over 200 jobs at risk.

The South Africa Illicit Economy 2.0 Report notes that illicit trade in tobacco and alcohol is estimated to cost the government R30 billion a year in lost revenue. “Illicit trade continues to pose a serious threat to South Africa’s economic stability, governance, and international standing,” the report stated.

Collop adds that medical aid tax credits have not kept pace with inflation, reducing their value over time. “Medical Scheme Fees Tax Credits have stagnated while medical aid premiums continue rising well above inflation, eroding the subsidy’s real value,” he says.

Another area where the taxpayer loses out is with Two-Pot withdrawals. “While it offers liquidity, withdrawals from your ‘Savings Pot’ are taxed at your marginal rate,” Collop says.

“I suspect many South Africans will unintentionally push themselves into higher tax brackets by making withdrawals, resulting in a tax bill they didn’t budget for. The immediate relief of cash today often comes with a severe tax headache tomorrow,” says Collop.

For taxpayers, Collop says the Budget is increasingly about managing erosion rather than expecting relief.

Strydom adds that there could be a gradual shift for medical tax brackets, with National Treasury taking a long-term approach of making incremental adjustments that erode the real value of medical tax credits. A small, inflation-linked increase in the fuel levy is possible, though a continued freeze remains possible given cost-of-living concerns.

Odendaal notes that Sars has made progress in raising tax collection and recovering tax debt. The South African Revenue Service (SARS) is expected to maintain its focus improved debt collection and enforcement, Strydom says.

Strydom notes that National Treasury will probably remain conservative, “looking for minor gains and redoubling on winning strategies”.

National Budget 2026 may introduce changes in several areas. FNB says these are the items South Africans should watch out for:

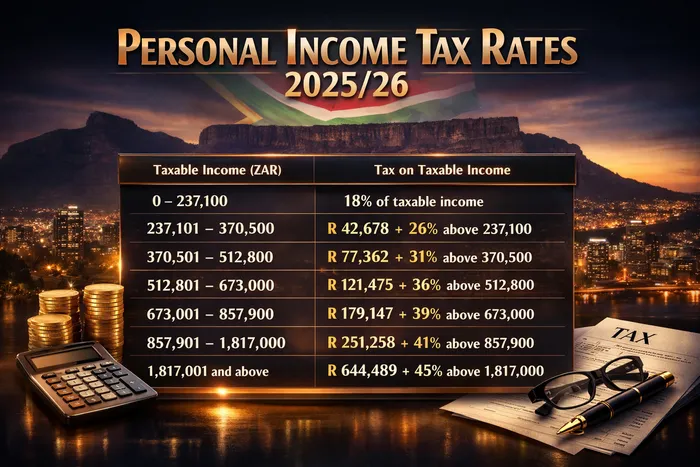

- Personal income tax: Changes to tax brackets or rebates affect take-home pay and savings strategies.

- Fuel levies and transport costs: Increases are felt immediately, quietly pushing up monthly expenses.

- Food inflation and indirect taxes: Even with VAT unchanged, indirect taxes and inflation raise everyday staple prices.

- Interest rate signals: The speech often hints at economic trends affecting borrowing costs for mortgages and credit.

- Social spending priorities: Budget allocations toward social grants affect household cost of living.

- Education costs: Budget decisions influence how families plan for education.

- Healthcare and medical tax credits: Adjustments affect affordability for households balancing medical cover.

- Sin taxes: Higher excise duties on alcohol and tobacco impact discretionary spending.

- Infrastructure and jobs: Spending signals future job creation.

- Government debt and confidence: Borrowing levels shape inflation expectations and interest rates.

PERSONAL FINANCE

Related Topics: